The first half of 2020 has seen a sharp increase in FSCS advice claims surrounding pensions and investments.

Newly released figures from the Financial Services Compensation Service (FSCS) show that claims surrounding mis-sold pensions and investments are on the rise. The FSCS received 5,763 claims related to pensions and investment advice between 1st January – 8th June 2020, compared to 4,804 in the same period last year, representing a 20% increase.

The news comes only a month after the FSCS announced it would be increasing the levy it imposes on financial firms in order to compensate clients. The levy was raised to £649m for this year. Financial advisers’ now find themselves contributing £229m to this figure.

£44m of this levy is expected to cover compensation costs for the collapse of London Capital & Finance.

Last month, speaking about the levy increase, the FSCS stated –

We now expect to make 7,700 decisions on these [SIPP] claims in 2020/21 which is a 114% increase on 2019/20.

It appears their expectation is becoming a reality.

The 2020 Mis-sold Pension and Investment Claim Figures so far

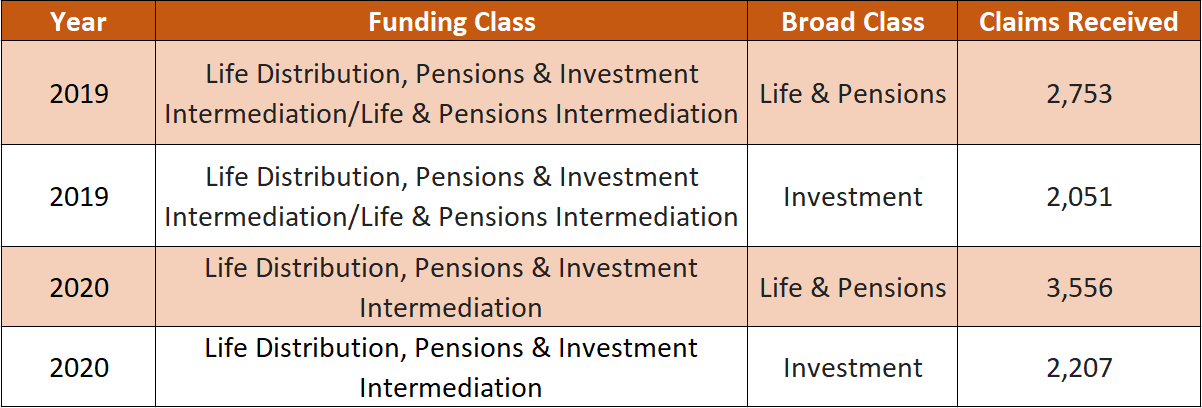

There have been a total of 959 more claims this year compared to last. Of the total for this year, 3,556 were related to pensions advice, while 2,207 were related to investment advice.

Source: FSCS. N.B. At the beginning of 2019 the funding classes were named differently to what they are named in 2020.

Last week, the FCA’s director of supervision, Megan Butler, stated that the financial advisers who push up the FSCS liabilities should not be “expected back in the regulatory space” in an effort to crackdown firms from phoenixing.

In February, 136 firms were being investigated by the FCA over these phoenixing concerns. Butler said:

We have seen all too often seen that historic poor conduct and resulting compensation bills can lead to firm failures, and that increases the FSCS levy.

Firms have avoided their liabilities to customers by so-called “phoenixing” and this is unacceptable.

How much more the FSCS mis-sold pensions and investment claims rise by until the end of the year remains to be seen.

How can Smooth Commercial Law help?

Have you been mis-sold a pension or investment product? Smooth Commercial Law may be able to help you claim compensation.

At Smooth Commercial Law, our team of experts have experience in dealing with a whole manner of claims that arise from negligent, fraudulent and/or unsuitable financial advice, including unsuitable transfers from pensions. We are seeing an increase in claims for mis-sold pensions and unsuitable investments, and have managed to secure compensation for many of our clients.

Should you have a claim for negligent financial advice, we can deal with your case and look to recover compensation for not just your loss of investment but also any adverse tax liabilities that you may now be facing as well.

You can contact our experienced team by calling 0800 046 9976 or by emailing sb@smooth-commercial-law.co.uk.