A £3m FSCS bill is just the tip of the iceberg, experts have warned.

A recent report into the British Steel pensions scandal has found that thirteen of the financial firms that advised members of the British Steep Pension Scheme (BSPS) have gone bust. Six of the thirteen were in conversation with the FCA at the beginning of the saga in 2016.

Financial planning publication, New Model Adviser, investigated ten of the firms that were named by the FCA in the scandal in a 2018 letter. Six of these have now gone into liquidation.

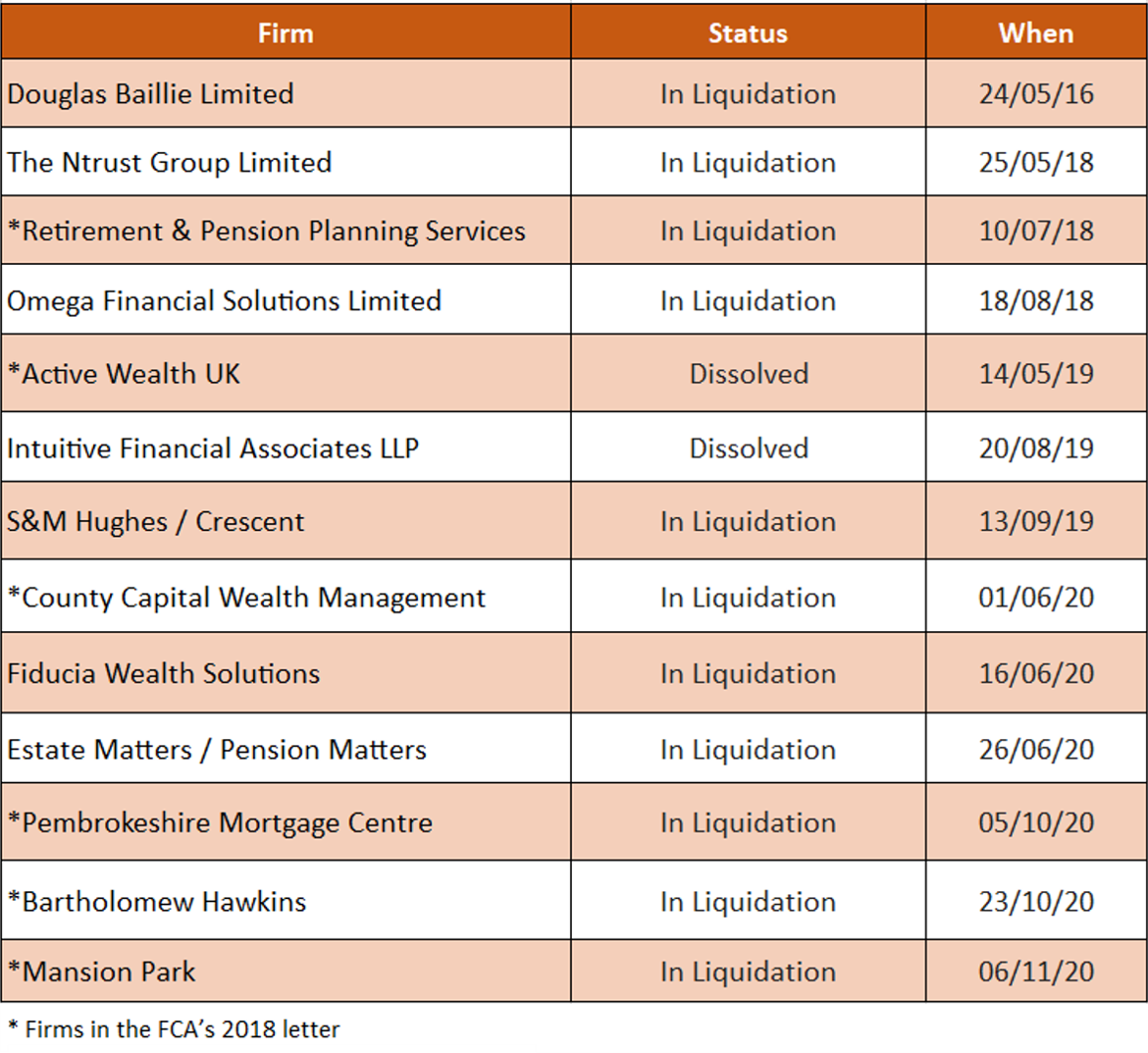

Another separate seven firms who are understood to have given pension transfer advice to BSPS members have also gone into liquidation bringing the total to thirteen. See below:

153 claims have been lodged against the thirteen firms, all related to British Steel pension mis-selling. In total, the FSCS has paid out £3.2m over British Steel-related claims, and there are suggestions this will continue to rise.

Only a handful of the claims have gone to the FSCS so far, with many more steelworkers still to come forward with a claim. Many are still unaware that they might have been misadvised, with some understanding the situation but unsure who to turn to to resolve the matter.

What happened with British Steelworkers’ pensions?

Earlier this year, 7,700 steelworkers who transferred out of their British Steel Pension Scheme (BSPS) were encouraged by the FCA to lodge a claim against their financial advisers.

The financial watchdog found that nearly half of the BSPS pension transfers in 2017 were unsuitable. This was part of a market-wide study into the suitability of defined benefit (DB) pension transfer advice, with the FCA looking at 192 cases of transfers out of the BSPS.

The FCA found that 47% of cases were unsuitable for transfer, while 32% appeared to contain information gaps. Only 21% appeared to be suitable.

Issues first began to emerge in 2016 when British Steel owner Tata was looking to sell the business. The pensions scheme had to be separated from the business due to its large deficit. The Government and the Pensions Regulator allowed the formation of “BSPS 2” which would offer members lower annual increase to their pensions.

Members were only given until the end of 2017 to decide whether they wanted to switch to BSPS 2, move to the Pensions Protection Fund, or transfer out of the scheme. Many members decided to transfer out of the defined benefit scheme after receiving independent financial advice.

Unions at the time, however, were very concerned that financial advisers were offering unsuitable advice and targeting the steelworkers.

How can I claim compensation if I have received poor pension advice?

If you have received negligent financial advice in relation to your British Steel defined benefit/final salary pension, you may be eligible to receive compensation from the Financial Services Compensation Scheme (FSCS). If the company you received advice from is no longer in business, like the above thirteen firms, the FSCS can compensate you up to £85,000 for any loss you have incurred.

The FCA and the FSCS are cracking down on poor defined benefit transfer advice, with the FCA launching over 30 enforcement investigations into financial firms who have given poor transfer advice to customers.

The FSCS is a statutory deposit insurance and investor compensation scheme. It can compensate clients if a financial firm is unable to. It has often been described as a “lifeboat” fun.

It is independent of the government and the financial industry, and was set up under the Financial Services and Markets Act 2000, becoming operational on 1 December 2001. They do not charge individual consumers for using our service.

Smooth Commercial Law have an extensive working knowledge of the FSCS and the process to achieve a successful outcome for clients having submitted a significant numbers of claims. The FSCS have protected more than 4.5m people and paid out £26bn in compensation.

How can Smooth Commercial law help?

Do you believe you have been the victim of a mis-sold defined benefit pension transfer? At Smooth Commercial Law our defined benefit lawyers are experts in pension mis-selling and can help you make a claim against your financial adviser if you feel you were not given the right advice or the risks of your investment were not properly explained to you.

We have successfully represented many individuals who have been badly advised and mis-sold a pension, helping them to get their pension back and recover the maximum compensation they rightly deserve.

We will be on hand to advise, guide and support you through each critical step of the claims process, ensuring you are kept fully informed and up-to-date on the progress of your claim. This will enable us to progress your claim with speed and efficiency so that all time frames and deadlines that apply to your case are met with ease and confidence. We will collect and collate all the supporting evidence needed to add strength and weight to your case, increasing your chance of getting the optimum level of compensation you deserve.

We have years of experience helping clients claim against their financial advisers for mis-sold pension claims. Smooth Commercial Law also operate on a No Win, No Fee basis, meaning there is no financial risk to you if you do choose to claim through us.

Should you have a claim for negligent financial advice, we can deal with your case and look to recover compensation for not just your loss of investment but also any adverse tax liabilities that you may now be facing as well.

You can contact our experienced team by calling *ruler number* or by emailing sb@smooth-commercial-law.co.uk.

Key Links

Defined Benefit Pension Transfer complaints up 44 percent

Nearly half of British Steel Pension Transfers were unsuitable